Cnidarian Economics

Rethinking the Automation of Finance with Chimerical Intelligence

2023

The globalised human economies exported a western model of growth based on the consumption of natural resources and the commodification of the living. The logic of such a model is based on the invention on an epistemological field of study that uses the vocabulary of finance, a digital dimension where value is quantified to define human’s economical development (GDP) and where price is considered as an information signal that allows markets to find their equilibrium. On top of the digitalisation of transactions, interaction within the economy are themselves encoded by a ubiquitous technology: money. This technology is supposed to embody society’s believes on value and as other technologies, it is an anthropogenic creation – it is artificial.

In other words, and since it relies on the intersubjective experience of humans, it only makes sense for humans. Money is used to store and exchange value through space and time, and thus allows strangers across the planet and across generations to co-operate. Butbecause money is an anthropogenic information, monetary system aren’t aligned with biological ones. The ambiguous mechanisms of money creation, often excused by the idea of a debt to be paid in the future, and the creation of financial wealth follow they own rules and limitations. Capitals aren’t correlated to physical reality and a minority of individuals can abuse this gap to cultivate their own “wealth”. Here lies the two syndromes of the economies of the Anthropocene.

First, the Economy is modelled in response to information generated by humans instead of sensing the ecological reality, although it is fully entangled with the flow of matter and energy provided by the planet. In fact, the human economy has a metabolism, but due to the rupture with the ecological informational context, this economy doesn’tregulateitselfaccordingtothe Earth’s metabolism, and thus turned into an energy and matter intensive structure.

Second, the mechanisms underlying the economy’s virtual representation are designed to make sense from the perception of the individuals that act in it. For this reason, market behaviours are driven by individual short-term interests and profits. Although someargue that the collective intelligence of markets allows the purest regulation of production and consumption of commodities, the supply and demand law drives the collective toward automated patterns of behaviours that don’t profit society as a whole.

In the end, profit is an information that only makes sense for humans, but what seems meaningful for human consciousness shouldn’t be taken as the hegemonic way to make sense of the reality. Ultimately, the anthropocentric perception of the world led human’s economy to be disconnected from nature’s economy and drives the current human civilisation to an unprecedented crisis as well as the rest of the living kingdom. It is now urgent for humans to reconciliate the biophysical metabolism of capitalism with the one of the biosphere and develop a symbiotic relationship between both economies. To create a society that nurtures and thrives from the living, humans must redesign the cognitive structures that shape their economy.

Consciousness and intelligence are always embodied and emerge in response to a subjective experience. In living organisms, the experience of reality is weaved from the perceptions of different senses. In other words, the reality perceived by a being is onlylimited to the threshold of information it can make sense of. It means that the reality to which humans consciously adapt their behaviour to is limited in regard to the diversity of beings and bio- chemical phenomenons on Earth. It also means that other sensors can offer new input to model other understandings of the world and ultimately to adapt the behaviour of bodies.

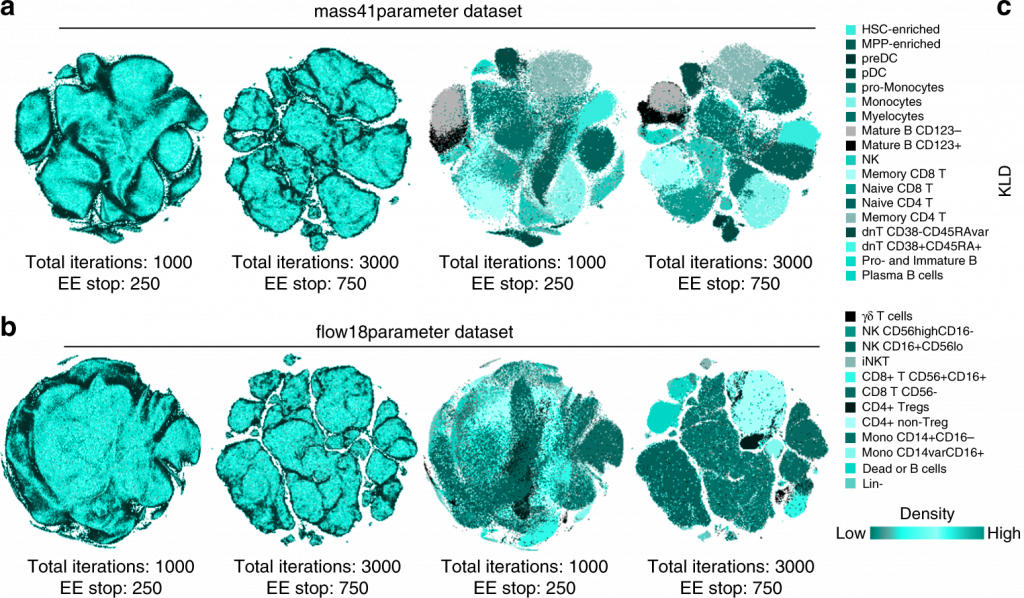

Fortunately, technology now opens other realities to sense and is adopted as a means to think through. In fact, silicon computation reached a level in which forms of autonomous intelligences share agency with humans: the automation of finance brings Artificial Intelligence as new agents regulating the economy. So far AI are programmed to response to the same informations as the one sensed by humans (mostly regarding profit) and are asked to reproduce the same patterns that conducted the economy to the current state. But just like neural networks are inspired by the human brain, what would it take to develop a computational model based on the functioning of another kind of cognition?

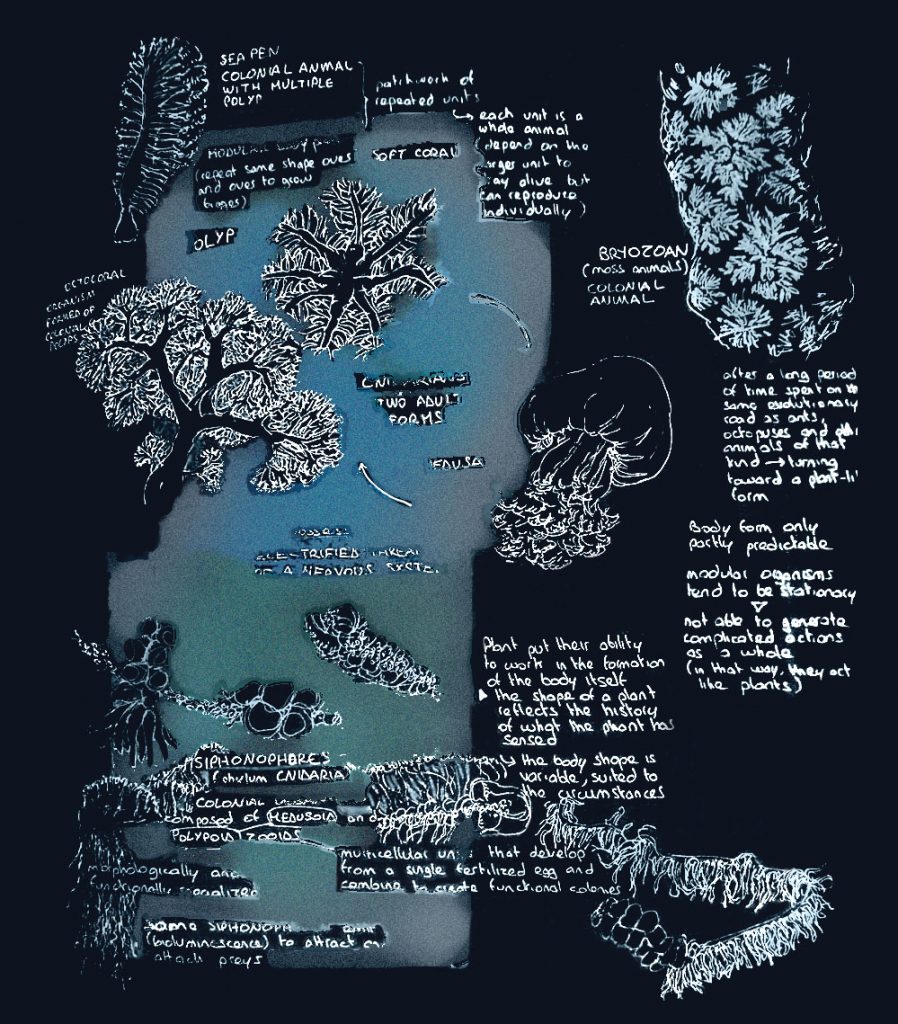

If we investigate the candidates for a non-anthropoinspired artificial intelligence that could diversify the kind of agents shaping the economy through finance we end up on the very interesting case of cnidarian. Unlike mammals, those animals (in the same phylum as jelly fishes) don’t have unitary but modular bodies. This feature comes from the fact that they are colonial animals: they are made or multitude of organisms living as partly-independent units and as a whole at the same time. Within all animals who developed anervous system, they are the farthest phylum from mammals. In fact, the neuronal network that goes through all the beings must be at the origin of a a kind of mind extremely different from the human’s one.

When we become aware that evolution developed such a variety of sentient beings, with diverse definitions of self, as closely related to us as animals, we can finally acknowledge that a consensus on reality is a danger for the multiplicity of entities inhabiting the Earth. A single monopole of intelligence (of and inspired by human’s brain) is at the heart of an economy disconnected from the rest of the living. In this matter, we need the agents structuring the financial networks to represent a diversity of intelligences, some inspired in unitary self-centred bodies, others by colonies of organisms with blended notion of self. The agency of stock markets would then be distributed between anthropo- inspired Artificial Intelligences (AI) and bio-diverse intelligences: Chimerical Intelligences (CI).

The distributed cognition enabled by financial systems could open up economics thinking with insights from all kind of intelligences. An investigation on the Cnidarian subjective experience and physical being appears to be an interesting choice to inspire CI that can offer a comprehension of the economy complementary to human’s perception. Together, such a multi-species network of agent will sense and make sense of the world, make judgment and create thoughts that could redefine not only the terms of money and transaction, but the whole definition of economics. A semantic understanding of the physical by CI is necessary to bridge the gap with the digital. Only at this condition would we avoid another disconnection between finance’s virtual synergy and the economy/ecology’s real one.